- On the Juice

- Posts

- Prediction Markets 201

Prediction Markets 201

The biggest benefits over a sportsbook

Thank you for being a reader.

If you want visibility into all of my wagers — subscribe to my profile on Juice Reel: InsiderOB.

I’ve hit 11 “Pick of the Day” bets in a row - will I win #12 today?

Hope everyone had a great Thanksgiving.

My highlights were going to MSG for the Illinois vs UConn game on Friday (and winning my UConn bet) and crushing this elegant fruit salad:

You gotta hit the pomegranate.

Two weeks ago, we started a multi-part series on exchanges (or prediction markets) vs sportsbooks — see Part 1 if you missed it.

Today I’m writing Part 2 of that series, highlighting the three biggest advantages I see with exchanges compared to traditional sportsbooks.

As always, we’ll look to keep winning and close with this week’s Bets of the Week!

Let’s get after it.

Pricing (using limit orders)

If you’re disciplined about pricing, and can leverage the concept of working orders (or limit orders), you can find better pricing on exchanges all the time.

Let’s illustrate this with an example.

The best price I see on the Timberwolves’ moneyline is -550 in their game tonight against the Pelicans.

Shopping on Juice Reel tells me that -550 requires you to have access to Hard Rock; otherwise you’re left paying -560 on FanDuel.

Here’s the line shopping table:

While that image shows the best price on Kalshi as -565, this is not the best you can do if you’re willing to be patient.

Rather than betting by “taking” the price of an existing counterparty (the -565 shown), you can put a bid in the Kalshi order book at $0.83 and wait for another bettor to come to you.

Doing so allows you bet $497 to win $100 (see image below), a massively better price of -497 (!!).

I’ve already gotten filled for 684 contracts.

The risk in using a limit order (vs a market order) is that you may never get filled and miss out on the bet you were seeking.

My experience on Kalshi, however, has been that big, liquid markets (NBA sides, NFL sides and totals, College Football sides and toals) frequently fill at the better price and significantly improve my ROI.

Next let’s highlight the benefits in betting futures.

Long-Term Bets (like season-long futures)

When you make a FanDuel bet on the Bears to win the Super Bowl in August, you tie up your money for six months and let FanDuel invest your cash.

This has been the case for decades, and it’s pretty uninspiring.

You’re forced to miss out on earning ~4% in a high-yield savings account just to bet six months out, which requires an even bigger edge to make this type of bet worthwhile.

Kalshi (and soon Polymarket) have disrupted this practice by paying interest on your positions.

Kalshi pays interest on both 1) uninvested cash in your account and 2) the underlying collateral for your open event positions.

They accrue interest daily on your total portfolio (cash + mark-to-market value of positions) and pay it out monthly.

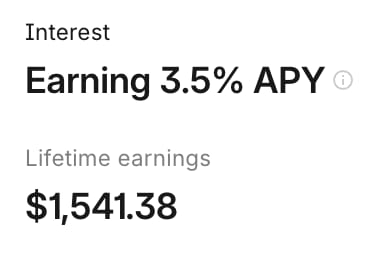

The rate is variable and moves with short-term rates, but launched at 4.05% APY in 2024 and as of today is paying 3.50% APY for eligible US accounts.

I’ve personally made over $1,500 on interest!

Polymarket pays a similar amount, but only on a list of long-dated futures.

In both exchange cases, futures bets that were previously tough to wager profitably have become much more compelling.

I placed my biggest offseason futures bet on Kalshi, and I’m trending very well on the Patriots to be a surprise division winner.

Betting the “No” (or alt-line unders)

Sportsbooks love offering markets where the bettor can only go one direction (typically “over” or “yes” bets).

For example, DraftKings will let me bet on more than 30 players to score a touchdown tonight, but they won’t let me bet even a single player to not score a touchdown.

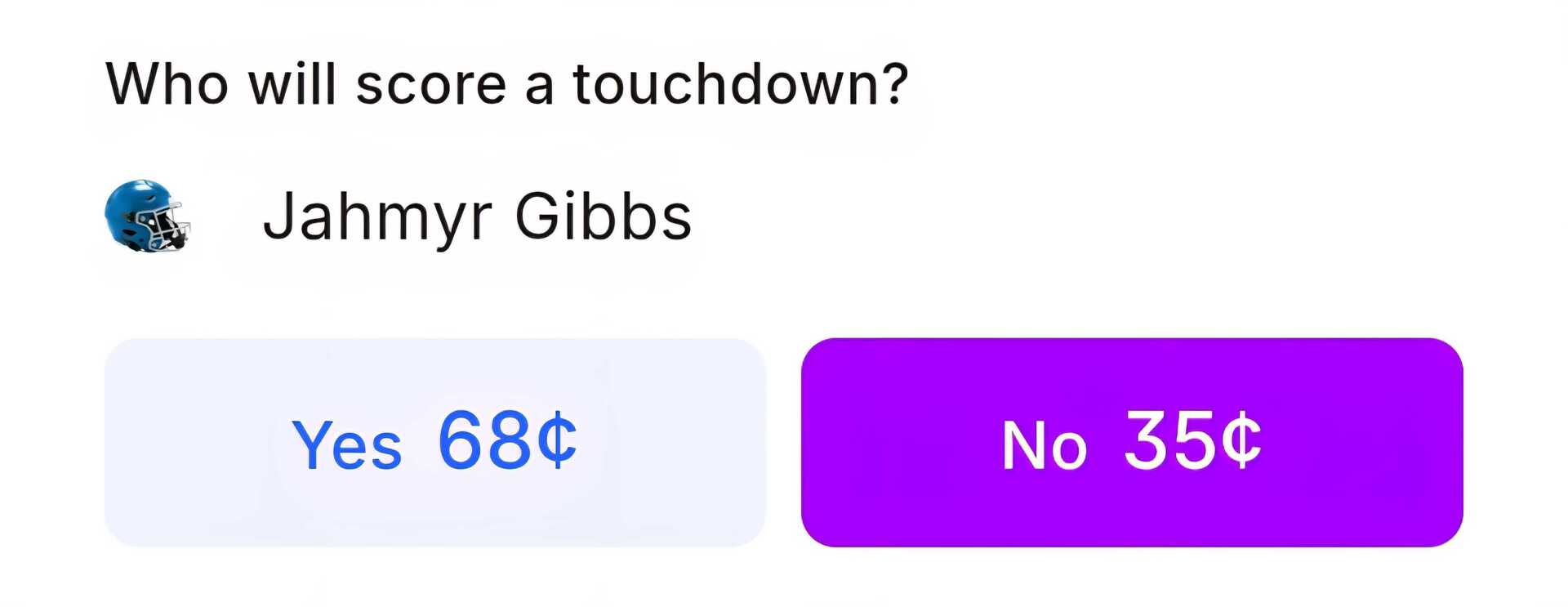

Kalshi, by contrast, offers two-way markets on every touchdown bet they list.

Here’s the pricing on Gibbs:

s long as there’s a counterparty to take your bet (or meet your price), you can bet players not to score, receivers, backs, and QBs to go under any listed yardage total, and basically bet any direction where you see edge.

Sportsbooks offer one-directional bets to charge more and exploit the tendencies of weaker bettors.

Prediction markets allow all of those opportunities for their users, leveling the playing field in a compelling way.

Bonus Category: Your Account Cannot be “Limited”

This may only be relevant for a portion of my audience, but exchanges will not limit your bet size if you are a winning bettor (!!).

As a person who can’t bet more than $3 on DraftKings SGPs, I put a lot of value on knowing a platform doesn’t require me to lose to run their business.

Bet(s) of the Week $$

Last week we booked a positive outcome.

We won with ease Wednesday night, as Amen Thompson crushed his line of 7.5 rebounds and finished with 14 (!!).

Sadly the Ravens didn’t deliver Thursday, as they turned the ball over 5 (!!) times.

Overall we had a net win of 0.07 units and we’re again at an all-time high!

Since starting the newsletter, bets in this section are ahead 24.1 units, with a positive 18% ROI. We’ll update this regularly.

Based on my research, I am making the following bet this week:

Cowboys +3.5 @ -110 on BetMGM for 0.5 units (Tonight)

Dallas comes in with the league’s most productive offense in yards per game and passing yards per game, while Detroit’s defense has been leaking explosive plays and struggling to generate consistent pressure. I like Dallas catching more than a field goal as a team that could win outright or back into a late cover by keeping the foot on the gas.

BYU +13 @ -110 on Fanatics for 1 unit (Saturday)

BYU’s earlier 29–7 loss in Lubbock was heavily turnover-driven (three BYU giveaways, including a muffed punt) rather than a pure yards-per-play mismatch, and since then BYU’s run game has surged behind LJ Martin (405 rushing yards and three TDs over his last three games), giving them a more balanced offensive profile for the rematch.

On a neutral field in Arlington, with BYU 11–1 and playing for a CFP shot just like Texas Tech, the underlying efficiency gap is smaller than the market implies, making +13 an attractive number.

Next week we’ll continue our deep dive into prediction markets.

Please fill out the survey about today’s newsletter and let me know your thoughts!

How did you like this edition?I'd love to hear from you |

Reply